Mortgage Refinance Deal Fundamentals Explained

Wiki Article

The Only Guide for Best Refinance Offers

Table of ContentsThe Definitive Guide for Mortgage Refinance DealThe Facts About Best Refinance Deals RevealedHow Best Home Loan Refinance Offers can Save You Time, Stress, and Money.Examine This Report on Best Refinance DealsThe Greatest Guide To Refinance Deals

Wondering if refinancing is the best relocation for you? Try to obtain an idea of what the total rate environment resembles. Use Smart, Property's price comparison device as a starting factor. If you're still trying to find a house, it can be frightening to find the right home for you.

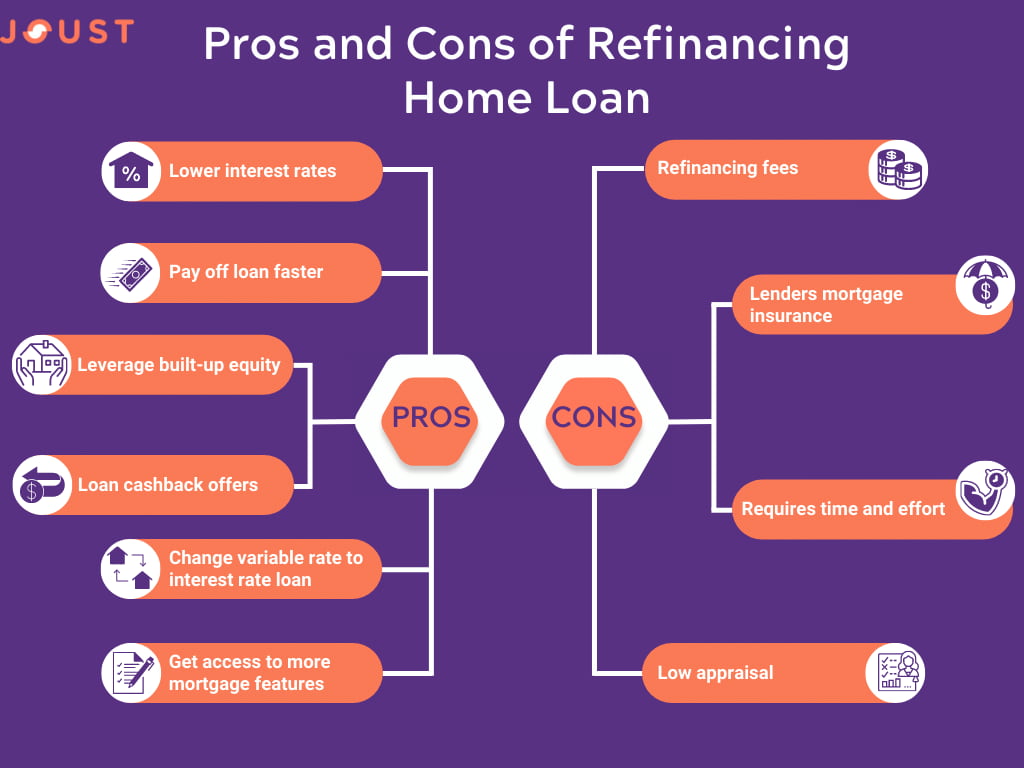

Home Mortgage Refinancing is when a debtor either changes their home mortgage item with a different one that normally has a lower rate under their existing or a brand-new lender. It indicates transforming your existing finance for a new one and for the most part, with a new bank. The 2 main reasons individuals look to refinance their home loans are either to get a much better price or to increase their existing funding to take out some home equity.

Unknown Facts About Mortgage Refinance Deal

Nowadays, financial institutions do not reward loyalty, and in many cases we locate lenders use far better offers to new clients instead of compensating their present ones. A re-finance home mortgage refers to the home loan product borrowers switch to. Lenders in some cases provide a different set of mortgage with their particular prices and functions for re-financing applications.There are several types of refinancing based on purchases with lending institutions. Right here are several of one of the most typical kind of refinancing: Kind Description Cash-out re-finance This alternative permits you to take a brand-new car loan on the residential or commercial property on top of your current loan utilizing your equity. Basically, you liquidate your ownership of the home to get some money that you can utilize for remodellings, repair work, or perhaps for a down payment for your next home acquisition.

This increases your equity while reducing your loan-to-value ratio. It will certainly also minimize your monthly responsibilities. Rate-and-term refinance Among the most usual reasons for refinancing is accessing a far better rate or renegotiate finance terms. Under this option, you have the ability to change your rate of interest or add car loan attributes.

Our Mortgage Refinance Deal PDFs

Combination re-finance Refinancing to place all your existing debt into a solitary financing account is called combination. mortgage refinance deal. With financial debt combination, you are able to complete repaying various other individual debts, allowing you to concentrate on simply one credit line. This works finest if you have a mortgage that has a reduced interest rate and very little charges

The difference, nevertheless, is that reverse home loan holders do not have to work out repayments. Still, however, there are prices that must be paid throughout the lending. Ensure to study the risks associated by reverse home mortgage prior to discovering this alternative. What are some factors for refinancing? It is mosting likely to come down to your personal situation, and your very own brief to medium term goals.

The Facts About Best Refinance Deals Uncovered

On the various other hand, spreading out your financing for a few even more years will help alleviate the financial worry. This, nevertheless, will certainly lead to you paying even more rate of interest over time. Bear in mind that Lenders and Bank might have different problems on allowing your Home mortgage Refinancing, read this blog post: If you currently have a variable home finance and you want to have the ability to protect your rate of interest, you will certainly need to re-finance to a fixed-rate home mortgage.This implies that the percentage of the total worth of your home that you actually have rises. Numerous debtors benefit from their equity by refinancing. If the real estate market is on the upside, there is a significant chance that their residential or commercial properties have actually appreciated. Refinancing will certainly allow you to take a portion of your built-up equity and utilize it to money any kind of big purchase, such as a financial investment residential or commercial property, a brand-new auto, or a renovation.

The brand-new evaluation will certainly assist your loan provider identify your loan-to-value ratio and just how much you may have the ability to obtain. One crucial point to bear in mind is to guarantee that as long as possible, your equity is greater than 20% of your residential or commercial property's value. In this manner, you will certainly not go through paying for Lenders Home loan Insurance Policy.

Best Home Loan Refinance Offers Can Be Fun For Anyone

If you require a guide on Home Equity Loans in Australia, read this post: Last but not least, you can re-finance to combine other lendings and debts right into a single and possibly extra budget friendly repayment. This can be convenient in circumstances where you have high-interest price car loans and debts like charge card, individual financings or auto lendings.Your old home mortgage will certainly be replaced by a brand-new one that includes the amount you used to pay those other financial obligations. Debt loan consolidation works well if you have whole lots of various bank card and are paying very high-interest prices. The only disadvantage when combining financial debts is to think about the brand-new funding term and what the complete rate of interest prices will seek you have actually combined every little thing.

Report this wiki page